A Government Subsidy to the Producers of a Product:

However there are losers in terms of opportunity cost. Cgovernment can improve the allocation of resources by imposing a per-unit tax on Z.

Governments can either reduce spending elsewhere or raise taxes.

. Producer and Consumer Subsidies 1. B increases product supply. A unit subsidy is a specific sum per unit produced which is given to the producer.

Although commonly extended from the government the term subsidy can relate to any type of support for example from NGOs or as implicit subsidies. Subsidies come in various forms. If the price of DVD players decreases we can expect that the demand for DVDs will.

Determinants of supply 98. Subsidies to producers reduce the marginal cost of supply. B increases product supply.

Agovernment can improve the allocation of resources by subsidizing consumers of Z. Economics questions and answers. Reduces product demand D.

A subsidy is a form of government intervention it usually involves a payment by the government to suppliers that reduce their costs of production and encourages them to increase output of a good or service. The government might also choose to grant a subsidy to producers of wheat in order to make them more competitive. C reduces product supply.

D reduces product demand. A government subsidy to the producers of a product. A subsidy usually leads to an increase in the output sold of.

Up to 256 cash back Get the detailed answer. Da government subsidy for producers of Z would ensure that consumers are paying directly for all of the benefits they receive from Z. In this case the new supply curve will be parallel to.

They may counter the shortfall in the availability of such goods with direct subsidies to producers of these commodities. By providing a subsidy the government allows producers to achieve lower costs of production. A government subsidy to the producers of a product.

This type of subsidy is provided in order to encourage the production of a. When a government places a subsidy on a product both the producer and consumer benefits. A reduces product demand.

Increases product supply. Types of Subsidies. That is the.

A subsidy is any form of government supportfinancial or otherwiseoffered to producers and occasionally consumers. LIMITED TIME OFFER. Bconsumers are paying too much for the good.

The WTO mentions five types of subsidies. A government subsidy to the producers of a product A reduces product demand B increases p. A government subsidy to the producers of a product.

Under a large subsidy ie s r 1 2 r 2 firm 1 cannot charge a monopoly price because such a high price will invite a high-cost manufacturer or firm 2 to enter the market also providing product C. A government subsidy to the producers of a product A reduces product demand B increases product supply C reduces product supply. Suppose that at prices of 5 4 3 2 and.

It says a subsidy is any financial benefit provided by a government which gives an unfair advantage to a specific industry business or even individual. A unit subsidy is a specific sum per unit produced which is given to the producer. Producer Subsidies A subsidy is a payment by the government to suppliers that reduce their costs of production and encourages them to increase output State subsidises are financed from general taxation or by borrowing The subsidy causes the firms.

Reduces product supply C. GET 20 OFF GRADE YEARLY. Increases product supply B.

A subsidy is an amount of money given directly to firms by the government to encourage production and consumption. Government Subsidy Policy and its Impact on Efficiency and Economic Growth. A government subsidy to the producers of a product _____________.

AIEEE Bank Exams CAT. Producer and Consumer Subsidies AS Micro Revision November 2013 2. D increases product demand.

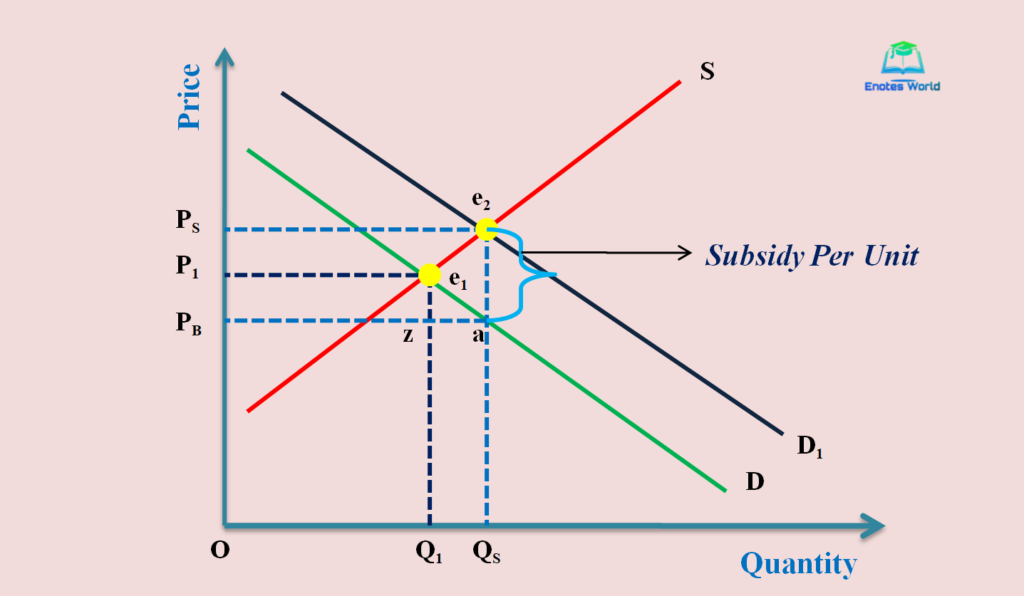

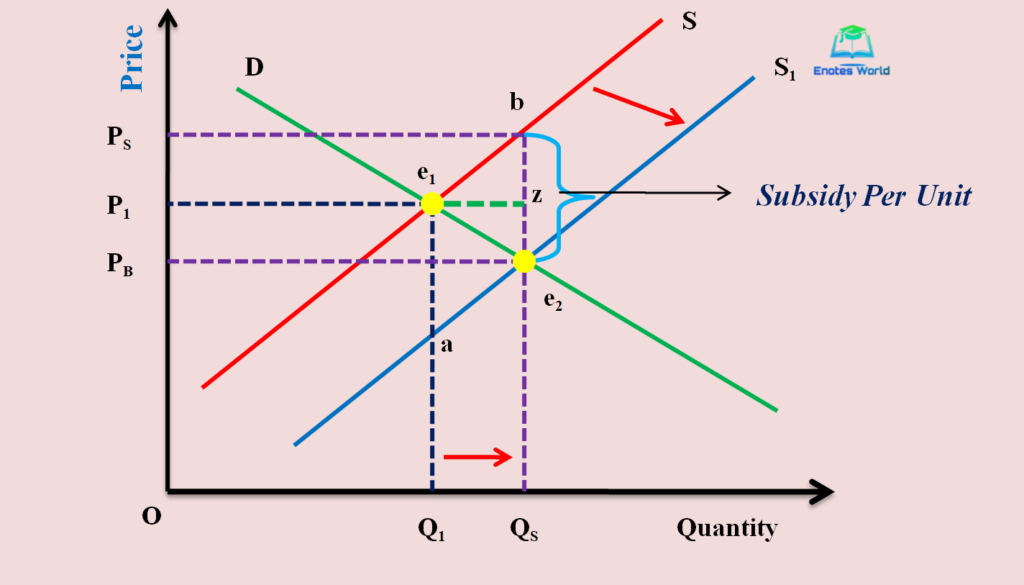

Producers can then in turn lower their prices and therefore hold their own more easily against foreign competitors. The effect of a specific per unit subsidy is to shift the supply curve vertically downwards by the amount of the subsidy. A subsidy is an amount of money given directly to firms by the government to encourage production and consumption.

A subsidy or government incentive is a form of financial aid or support extended to an economic sector business or individual generally with the aim of promoting economic and social policy. Cash subsidies such as the grants mentioned above. A government subsidy to the producers of a product a.

Government subsidies help an industry by paying part of the cost of production offering tax credits or paying part of the cost a consumer would pay. Basically subsidies are provided by the government to specific industries with the aim of keeping the prices of products and services low for people to be able to afford them and also to encourage production and consumption. A government subsidy to the producers of a product.

Tax concessions such as exemptions credits or deferrals. The effect of a specific per unit subsidy is to shift the supply curve vertically downwards by the amount of the subsidy. In this case the new supply curve will be.

C increases product supply. In Egypt Iran Mexico and other developing countries the prices of staple items. Watch the short video on bread subsidies in Egypt and then answer the following questions.

Up to 256 cash back A government subsidy to the producers of a product. Therefore only product C from firm 1 is sold and the selling price depends on the unit subsidy from the government. Many governments in developing countries adopt price controls for basic consumer goods.

Effect Of Subsidy In Market Equilibrium Microeconomics

Comments

Post a Comment